5 Reasons Why You Should Consider Shophouse As Your Next Property Investment

- Vivian Chong

- Aug 19, 2020

- 6 min read

Updated: Jan 15, 2024

Conservation shophouses are a historical source of delight and nostalgia. It is an architecture filled with the heritage of Singapore, bringing us through the olden days from the early 1800s to mid-1900s.

Nowadays, shophouses are not just a showcase of Singapore's culture. Many property investors are increasingly looking at shophouses as a unique asset class.

Before we discuss why you should consider shophouses as your next property investment, let's look at the pulse of the shophouse market in Singapore. Which shophouses were recently transacted? And which prominent shophouses were put up for sale recently?

Shophouse Investment Scene in Singapore

Shophouse For Sale

There is an array of activities in the shophouse market. A number of units are listed for sale. Some of them as below:

2 shophouses in highly prominent locations - Sixth Avenue and Lorong Mambong - were put up for sale, generating many enquiries (EdgeProp: Breaktalk boss offers prime shophouse for sale).

3 shophouses in Chinatown area were listed in the market for $30,500,000 (Business Times: Three conservation shophouses in Chinatown up for sale at S$30.5m total guide price).

2 corner shophouses in Lavender area were listed at $13,200,000 (Straits Times: 2 corner shophouses for sale with $13.2m guide price).

Besides the above shophouses which come with a bigger price tag, there are also a number of shophouses with a more palatable price put into the market for sale. During this pandemic, many shophouse owners might look into divesting their investments.

At the same time, there is an increase in the sales of shophouses when Singapore enter into Phase 2 of reopening after the circuit breaker period, According to the URA website, there were 11 shophouses transacted in June and 7 transacted in July while no shophouses were transacted in the month of May.

Buyers are on the lookout for good value shophouses.

Recent Transactions

The biggest conservation shophouse transaction this year was 14 Mohamed Sultan Road. This 999-years leasehold property sits on a land size 2,476sqf and was sold at $12,200,000.

This was followed by 4-storey shophouses at 297 Tanjong Katong Road. This shophouse has a land size of 3,811sqf and gross floor area of about 11,530sqf. It has a freehold tenure and was sold at $11,000,000.

A number of shophouses with a more bite-sized quantum of $6,000,000 and below were also transacted.

Amidst the deep recession that we are in, why are shophouses still commanding much interest from property investors?

Why Do Investors Like Shophouse?

(1) Shophouse holds value well

There is a limited supply of shophouses, especially conserved shophouses. According to the Urban Renewal Authority (URA), there are about 6500 units of conserved shophouses in Singapore.

Let's take a look at the price trend of shophouses in the Tanjong Pagar Conservation Area over the past 20 years.

Prices of shophouses have increased steadily over the past 2 decades. The average price was $377psf in March 2000, and it appreciated to $6,756psf in July 2020.

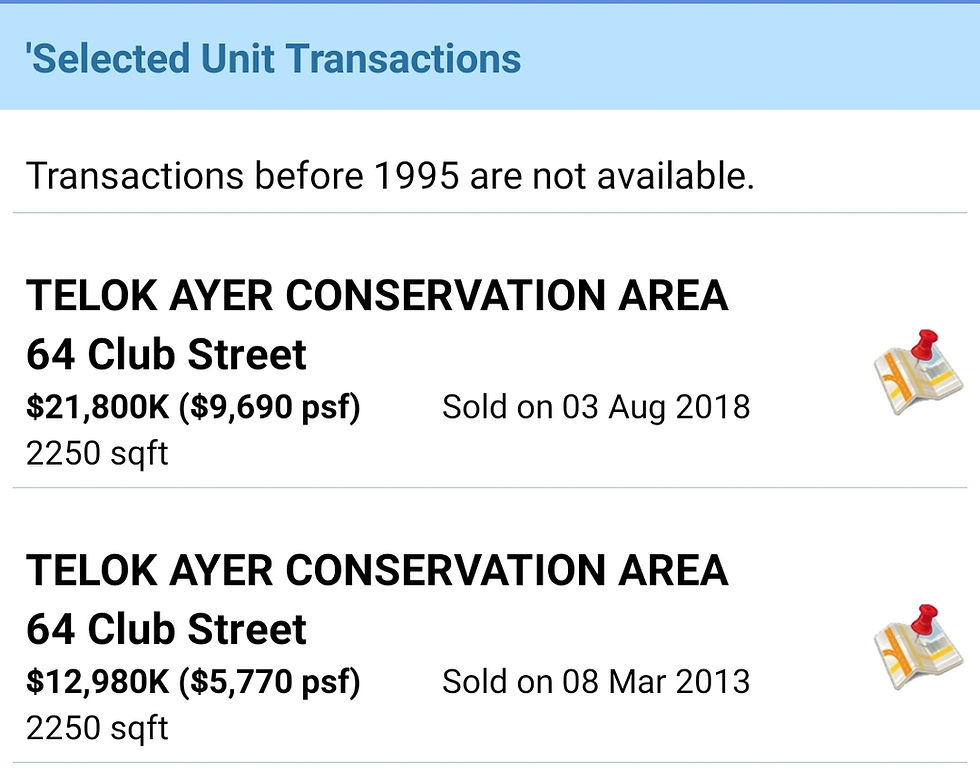

Let's look at a shophouse located on 64 Club Street. It was transacted on 25 Jan 2019 at $21,800,000. This unit was bought by the previous owner on 8 Mar 2013 at $12,980,000. This was an increase of 68% within 6 years.

Another example is 77 Amoy Street. It was sold at $14,441,000 on 16 Jan 2013 and last transacted at $25,000,000 on 22 March 2018. This was an increase of 73% within 5 years!

Let's also look at the price trend of city-fringe shophouses at Little India Conservation Area.

Average prices of shophouses increased from $616psf in March 2000 to $6,756psf in July 2020.

It is important to note that for shophouses, we should not only look at the psf price based on land size. It is also important to look at the built-up area as the bigger the built-up area, the higher the value of the property.

The scarcity of shophouses preserves the value, much like limited edition art pieces. It is not difficult to foresee how prices will move for shophouses of such scarcity.

(2) Foreigners eligible to buy shophouses zoned for commercial use

Foreigners are eligible to buy shophouses zoned for commercial use, as opposed to landed residential properties where they have to seek approval from Land Dealings Approval Unit under Singapore Land Authority (Read more on Foreign Ownership of Properties).

Singapore is an attractive country for foreign investors. The stability of Singapore's political situation, low tax environment, advance infrastructure, skilled workforce and a stable property market are reasons why foreigners love to invest in Singapore.

Shophouses in Central Business District (CBD) appeal especially to foreigners from China and Hongkong.

Buying shophouses allow foreigners to own a piece of land in a land-scarce country like Singapore.

(3) No Additional Buyer's Stamp Duty (ABSD) and Seller's Stamp Duty (SSD)

To ensure a stable property market and prevent overheating to the residential market, Singapore's government implemented many rounds of cooling measures to the residential property market.

Some of these measures include:

(1) Seller Stamp Duty (SSD), which imposes stamp duty on sellers who sell their residential properties within 3 years of purchase;

(2) Additional Buyer's Stamp Duty (ABSD), which imposes additional stamp duty on Singaporeans for purchase of 2nd and subsequent residential properties, as well as foreigners who are buying residential properties in Singapore.

(3) Loan To Value (LTV) for second and subsequent properties, which limits the loan buyers can take for the purchase of 2nd and subsequent properties;

(4) Mortgage Servicing Ratio (MSR) for HDB properties, which limits the loan buyers can take for the purchase of HDB properties.

(5) Total Debt Servicing Ratio (TDSR) for all mortgage loans, which limits the loan buyers can take for the purchase of properties.

SSD and ABSD do not apply to commercial properties. These attract investors, especially multi-property owners who perceived commercial shophouses as a better investment option.

(4) Unique Business Presence For Tenants

Some tenants prefer to have their business located in a shophouse, due to the unique characteristics and charm of a shophouse.

A good example will be F&B tenant. Instead of having their restaurants or cafes located in shopping malls, shophouse brings more character to their business,

Blu Jaz Cafe, located at 11 Bali Lane off Haji Lane, is one of those who benefit from a shophouse presence in an area popular with F&B establishments.

On a side note, 11 Bali Lane was sold to a South Korean party at $18,800,000 in Oct 2019. This is a 3 level shophouse with a total built-up area of around 4,680sqf, which works out to be $4,017psf on built-up area.

Shophouses in CBD are attracting many office tenants too. They are seen as a more affordable alternative to the office buildings in Raffles Place and Marina areas.

Instead of the conventional office, many FinTech and creative firms like advertising and design companies also look at shophouse as a premise more suitable for their trade.

(5) Lots of space, despite a small land area

Shophouses may have a narrow frontage but it has deep rears. The land size might be small, but the built-up area is huge as it is mostly 2 to 3 storeys.

A good example is 23 Ann Siang Road. This shophouse has a land size of 1,331sqf. It is 3 storeys high and the total built-up area is 3,111sqf.

Another example is 89 Amoy Street. This shophouse has a land size of 2,854sqf. It is 3 storeys with an attic and the total built-up area is 7,440sqf!

Investors may buy a single storey shophouse and redevelop it to 2 or 3 storeys with the maximum Gross Floor Area (GFA). They can then either rent out the whole unit, or have a few tenants occupying the different levels of the shophouse.

Conclusion

With economic uncertainties around the world, conservation shophouses offer capital preservation and stability due to their strong heritage value and limited supply.

There will continue to be interest from foreign and local buyers as investors find shophouses a safe haven. Demand volume is expected to return as high-net-worth individuals invest in shophouses as a means for stable recurring income, wealth preservation and capital appreciation over time.

If you would like to find out more about investing in a shophouse, please feel free to drop me a message. You can also schedule an appointment with me using the link below.

See you soon!

Related Readings

About The Author

Vivian is an experienced real estate agent who has been in the industry since Year 2002.

Over the years, she has transacted many properties including residential and commercial properties. She is well-versed in policies and regulations involving the sale and purchase of such properties. She has also worked with many clients to restructure their property portfolio.

Vivian is a mother to 2 boys. Being a real estate mom allows her to spend more time with her children as they were growing up. Both boys are avid footballers representing their schools and clubs. She loves watching their games and hardly miss a game whenever they play.

Vivian is an active real estate salesperson and team leader. Call her at 98577714 for your real estate matters, or if you are looking to join the real estate industry.

%20copy.png)